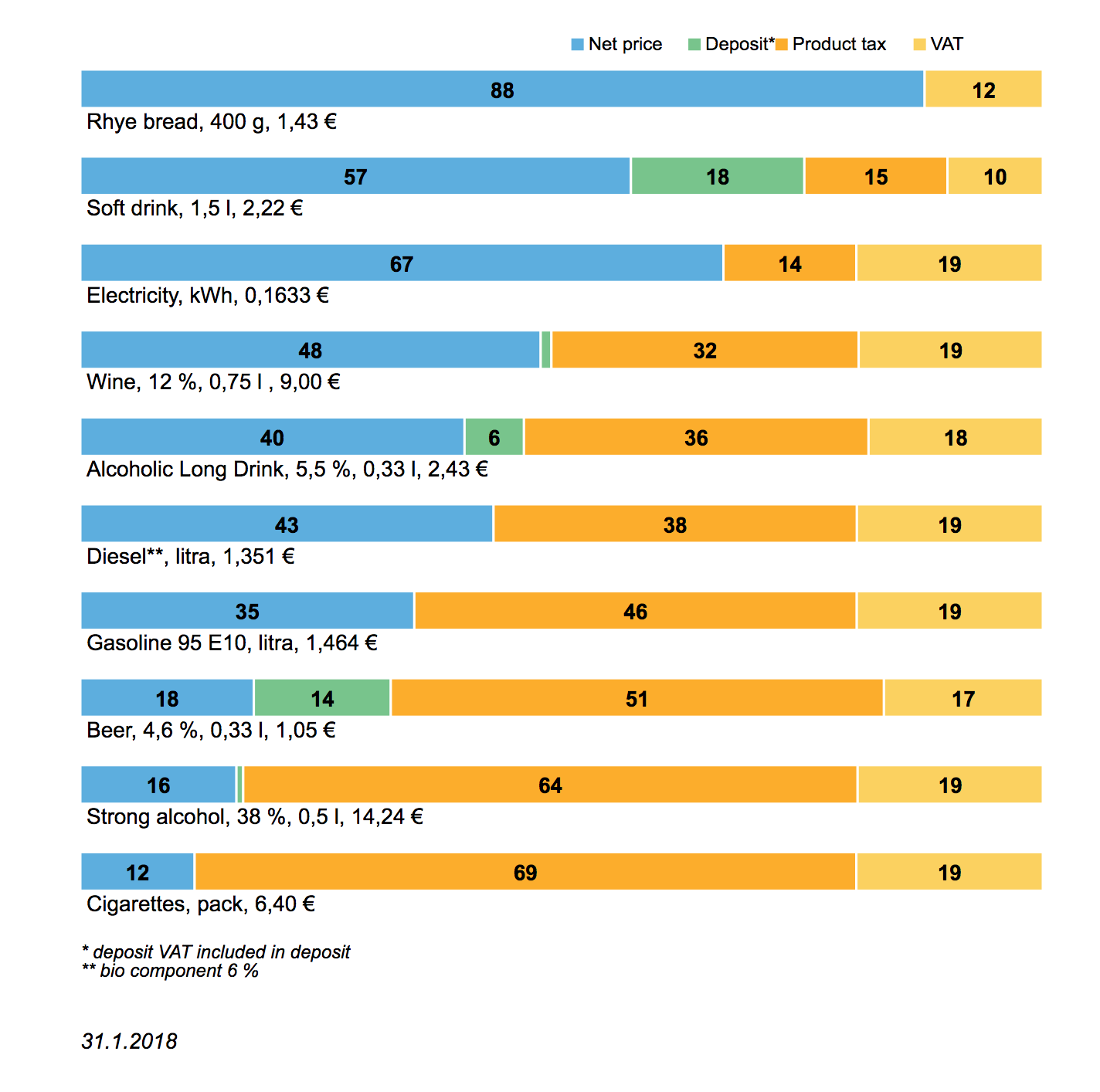

Sample consumption taxes in Finland

The Taxpayers Association of Finland (TAF) has released their annual calculations consumption taxes in selected products. When a consumer buys products they pay mostly Value Added Tax (VAT), but some products also have production taxes.

Typical production taxes in Finland are alcohol tax, energy tax, tobacco tax and candy tax. The rates are specificied by individual products, and are defined as euro or cents for a specific weight, number or strength.

The association is an independent organisation for employees, pensioners and entrepreneurs. Founded in 1947 the association does not receive (or accept) public assistance. With over 190,000 private members and 44,000 company members it helps members in tax related issues, and promotes reasonable taxation

In it's annual calculations TAF wants to highlight the amount of taxes in products. In these calculations the prices are split to VAT, production tax and net price. Some products can include deposits, and the VAT is included in the deposit. This is most common for drinks where the deposit is paid back full when bottles are returned to recycling.

Products in the calculation samples include foodstuffs, tobacco, alcohol and energy: Rhye bread, Soft drink, Electricity, Wine, Alcoholing Long Drink, Diesel, Gasoline, Cigarettes. Products with the low tax are high, where as highly taxed products are at the bottom.

Source: Kulutusveroja koskevat esimerkkilaskelmat